Shares of Lowe’s Companies, Inc. (NYSE: LOW) were up 1% on Tuesday. The stock has dropped 3% in the past three months. The home improvement company is scheduled to report its earnings results for the third quarter of 2025 on Wednesday, November 19, before market open. Here’s a look at what to expect from the earnings report:

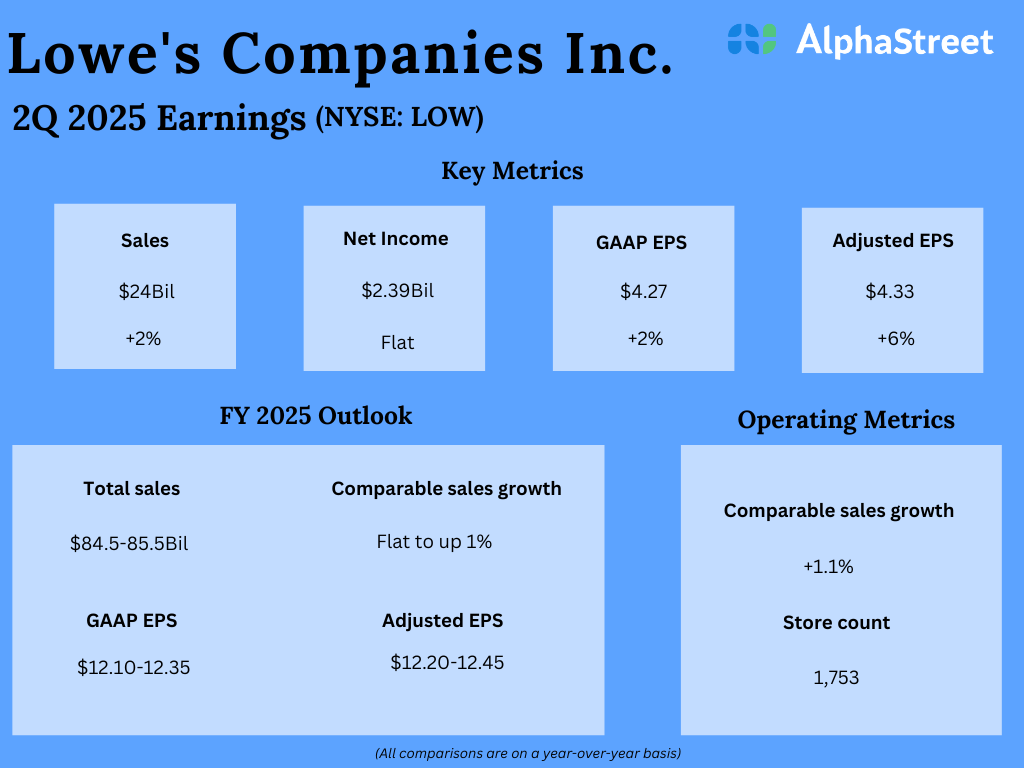

Analysts are projecting revenue of $20.9 billion for Lowe’s in the third quarter of 2025, indicating an increase of over 3% from the same period a year ago. In the second quarter of 2025, total sales increased 2% year-over-year to $24 billion.

The consensus target for earnings per share in Q3 2025 is $2.99, which implies a 3% growth versus the prior-year quarter. In Q2 2025, adjusted EPS rose around 6% YoY to $4.33.

On its Q2 earnings call, Lowe’s said it expected the home improvement market to remain roughly flat and for consumer and home improvement trends seen during the first half to persist going forward. The company guided for comparable sales in the third quarter to be approx. 125 basis points above the bottom end of its full-year guidance range of flat to up 1%. In Q2, comparable sales grew 1.1%.

Lowe’s is likely to see positive performances in both the Pro and DIY segments. Its efforts to drive growth in Pro through its Total Home Strategy is yielding benefits. It is also seeing growth in online sales, helped by its loyalty program.

The home improvement company can be expected to benefit from an aging housing stock which will require continued maintenance, pent-up demand from delayed projects, and rising demand for new homes.

After seeing growth with small-to-medium Pro customers, Lowe’s is now turning its focus to the Larger Pro customer, a segment with vast potential. The company’s recent acquisitions are expected to help drive growth in this segment. After the acquisition of ADG, LOW has now acquired FBM, which specializes in products such as drywall, metal framing, and ceiling systems. This acquisition is expected to help the company diversify its customer base and expand its Pro footprint and capabilities significantly.

The post Lowe’s (LOW) Earnings Preview: Revenue and earnings anticipated to grow in Q3 2025 first appeared on AlphaStreet.

—

Blog powered by G6

Disclaimer! A guest author has made this post. G6 has not checked the post. its content and attachments and under no circumstances will G6 be held responsible or liable in any way for any claims, damages, losses, expenses, costs or liabilities whatsoever (including, without limitation, any direct or indirect damages for loss of profits, business interruption or loss of information) resulting or arising directly or indirectly from your use of or inability to use this website or any websites linked to it, or from your reliance on the information and material on this website, even if the G6 has been advised of the possibility of such damages in advance.

For any inquiries, please contact [email protected]