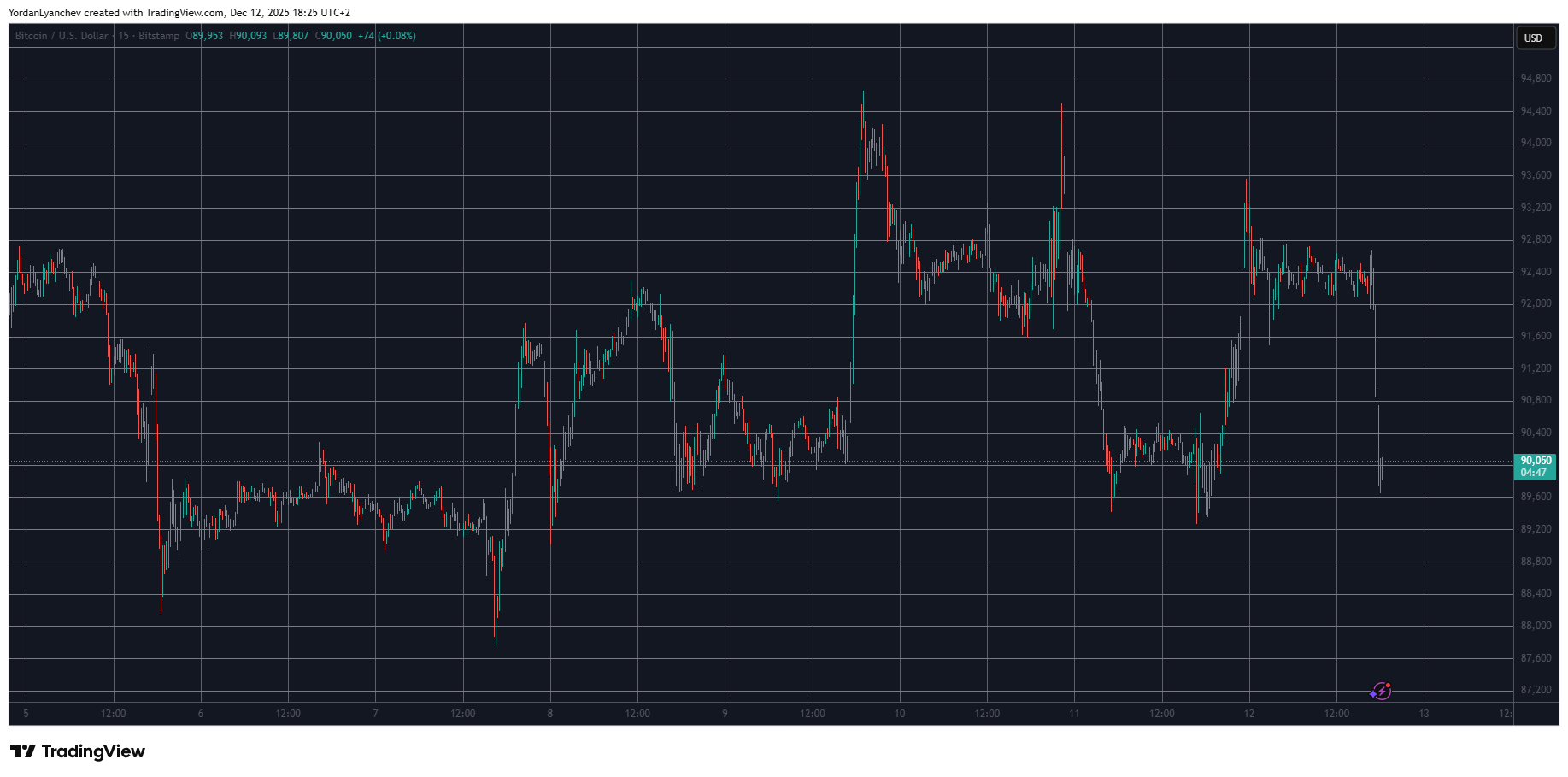

The price movements from last Friday repeated, with bitcoin tumbling several grand in just minutes, dropping below $90,000.

Most altcoins followed suit, and it’s no surprise that the total value of liquidated positions has rocketed past $400 million.

CryptoPotato reported just over an hour ago that BTC’s price had stabilized above $92,000 after the highly volatile week it had. Recall that the asset skyrocketed from under $90,000 to over $94,000 before and after the US Federal Reserve reduced the interest rates mid-week.

However, it slipped beneath $89,500 yesterday before the bulls initiated an impressive leg up to $93,600. Bitcoin was stopped there but maintained a healthy price tag of around $92,300 until an hour ago, when it suddenly dropped to $89,600.

It has managed to recover some ground and is now testing the $90,000 mark. Most altcoins have followed suit with even more painful declines within the same timeframe.

Ethereum is among the poorest performers, having lost 4.5% of value and now sitting just inches above $3,000. Just a few days ago, ETH flew past $3,400 but met a violent rejection at that point.

ARB, UNI, ENA, and AAVE have dumped by up to 5.5% in the past hour. As such, the total value of wrecked positions has jumped to $415 million on a daily scale, with $163 million coming in the past hour alone.

More than 120,000 traders have been wiped out daily, while the single-largest liquidated position (worth $5.7 million) took place on Hyperliquid.

The post Bitcoin Crashes $3K in Minutes as Liquidations Explode Again on Friday appeared first on CryptoPotato.

—

Blog powered by G6

Disclaimer! A guest author has made this post. G6 has not checked the post. its content and attachments and under no circumstances will G6 be held responsible or liable in any way for any claims, damages, losses, expenses, costs or liabilities whatsoever (including, without limitation, any direct or indirect damages for loss of profits, business interruption or loss of information) resulting or arising directly or indirectly from your use of or inability to use this website or any websites linked to it, or from your reliance on the information and material on this website, even if the G6 has been advised of the possibility of such damages in advance.

For any inquiries, please contact [email protected]