Shares of The Walt Disney Company (NYSE: DIS) fell 9% on Thursday after the company delivered mixed results for the fourth quarter of 2025. While earnings beat expectations, revenues fell short. The entertainment giant has guided for earnings growth in the coming fiscal year. Disney’s streaming business continued its momentum even as its linear TV business witnessed declines.

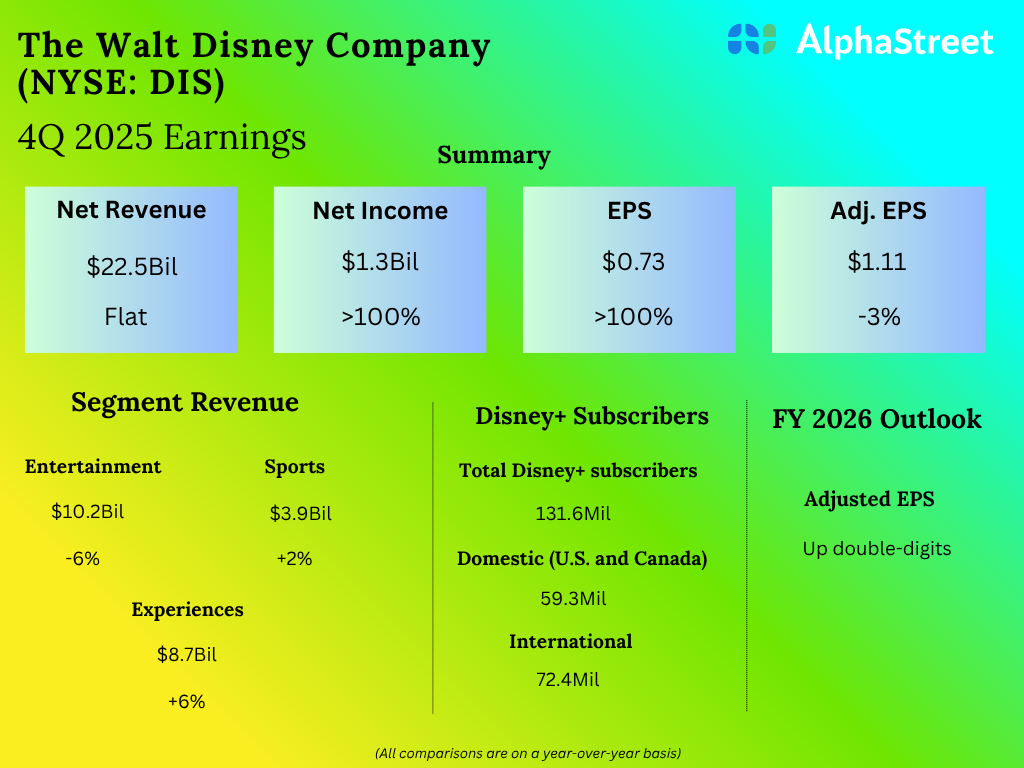

Disney posted revenues of $22.5 billion in the fourth quarter of 2025, which were comparable to the year-ago period but below estimates of $22.7 billion. GAAP earnings per share increased to $0.73 from $0.25 last year. Adjusted EPS decreased 3% year-over-year to $1.11 but surpassed expectations of $1.02.

In Q4, Disney’s Entertainment segment recorded a 6% decrease in revenues, as growth in streaming was offset by declines in linear networks. Direct-to-Consumer (DTC) revenue increased 8% in the quarter. DTC’s operating income rose 39%, helped by higher subscription revenue, driven by growth in subscribers and average revenue per user (ARPU).

The company ended the quarter with 195.7 million Disney+ and Hulu subscriptions, reflecting an increase of 12.4 million sequentially, driven by higher wholesale Hulu subscriptions. At quarter-end, Disney+ had 131.6 million subscribers, up 3% sequentially, with growth in both international and domestic subscribers. Domestic subscribers grew 3% while international subscribers were up 4% sequentially.

Disney saw strong viewership of its content on its streaming platforms during the fourth quarter, driven by television series such as Alien: Earth, High Potential, and Tempest. It has several popular titles coming out over the next few months, which are anticipated to drive continued engagement.

Linear Networks’ revenues decreased 16% in Q4, with decreases in domestic and international revenues of 7% and 56% respectively. Operating income was down 21%. Domestic Linear Networks operating income declined 5% in the quarter due to lower advertising caused by decreases in viewership and political advertising.

For fiscal year 2026, Disney expects adjusted EPS to grow double-digits compared to fiscal year 2025. The company expects double-digit percentage segment operating income growth for the Entertainment segment compared to FY2025, weighted to the second half of the year.

The post Disney’s (DIS) streaming business continues its momentum in Q4 2025 first appeared on AlphaStreet.

—

Blog powered by G6

Disclaimer! A guest author has made this post. G6 has not checked the post. its content and attachments and under no circumstances will G6 be held responsible or liable in any way for any claims, damages, losses, expenses, costs or liabilities whatsoever (including, without limitation, any direct or indirect damages for loss of profits, business interruption or loss of information) resulting or arising directly or indirectly from your use of or inability to use this website or any websites linked to it, or from your reliance on the information and material on this website, even if the G6 has been advised of the possibility of such damages in advance.

For any inquiries, please contact [email protected]