NXP Semiconductors N.V. operates as a global supplier of mixed-signal semiconductor solutions. The company serves automotive, industrial, mobile, and IoT markets. Recent results indicate stable demand trends. Operations remain focused on high-margin segments.

Shares recently traded near USD 226. The stock has shown moderate volatility in recent sessions. Price movement reflects earnings-related activity.

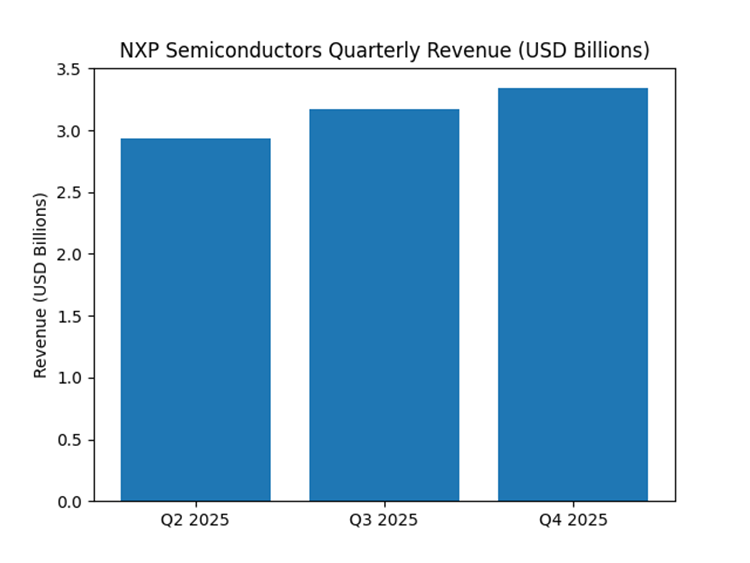

Revenue increased sequentially over the last three quarters. Q2 2025 revenue was USD 2.93 billion. Q3 2025 revenue was USD 3.17 billion. Q4 2025 revenue reached USD 3.34 billion.

NXP maintains a strong position in automotive semiconductors. Industry conditions remain cyclical. Automotive and industrial demand continues to support revenue stability. Competition remains intense among global chipmakers.

Analysts generally expect stable near-term performance. Views remain mixed on the pace of broader market recovery.

No new mergers or acquisitions were reported in the most recent quarter.

Management expects steady demand in core segments. The outlook remains subject to global semiconductor market conditions.

The post NXP Semiconductors Q4 2025 Revenue Above Guidance; Automotive and Industrial Demand Highlighted first appeared on AlphaStreet.

—

Blog powered by G6

Disclaimer! A guest author has made this post. G6 has not checked the post. its content and attachments and under no circumstances will G6 be held responsible or liable in any way for any claims, damages, losses, expenses, costs or liabilities whatsoever (including, without limitation, any direct or indirect damages for loss of profits, business interruption or loss of information) resulting or arising directly or indirectly from your use of or inability to use this website or any websites linked to it, or from your reliance on the information and material on this website, even if the G6 has been advised of the possibility of such damages in advance.

For any inquiries, please contact [email protected]