The launch of the spot XRP ETFs (exchange-traded funds) in the United States was one of the rare success stories of 2025’s final quarter. The crypto-linked products have helped ensure significant capital influx into the altcoin in recent months.

While the XRP ETFs recorded their first negative outflow day in the past week, the exchange-traded funds also reached a new record in terms of the total value traded in a single week. This milestone reflects the growing maturity of the XRP ETF market in the US.

According to the latest market data, the spot XRP ETFs posted their highest weekly trading volume since debut at $219 million. This figure is almost double the value traded in the XRP ETF market in the previous week ($117.4 million).

Meanwhile, this new record merely surpasses the previous record of $213.9 million reached in the third week of December 2025. This feat signals the rising investor demand for the XRP exchange-traded funds despite the waning interest in the broader crypto ETF market.

As mentioned earlier, the US-based XRP ETFs registered their first negative performance in the past week, with a net outflow of $40.8 million on Wednesday, January 7. However, this single-day performance didn’t stop the exchange-traded products from ending the week in the green.

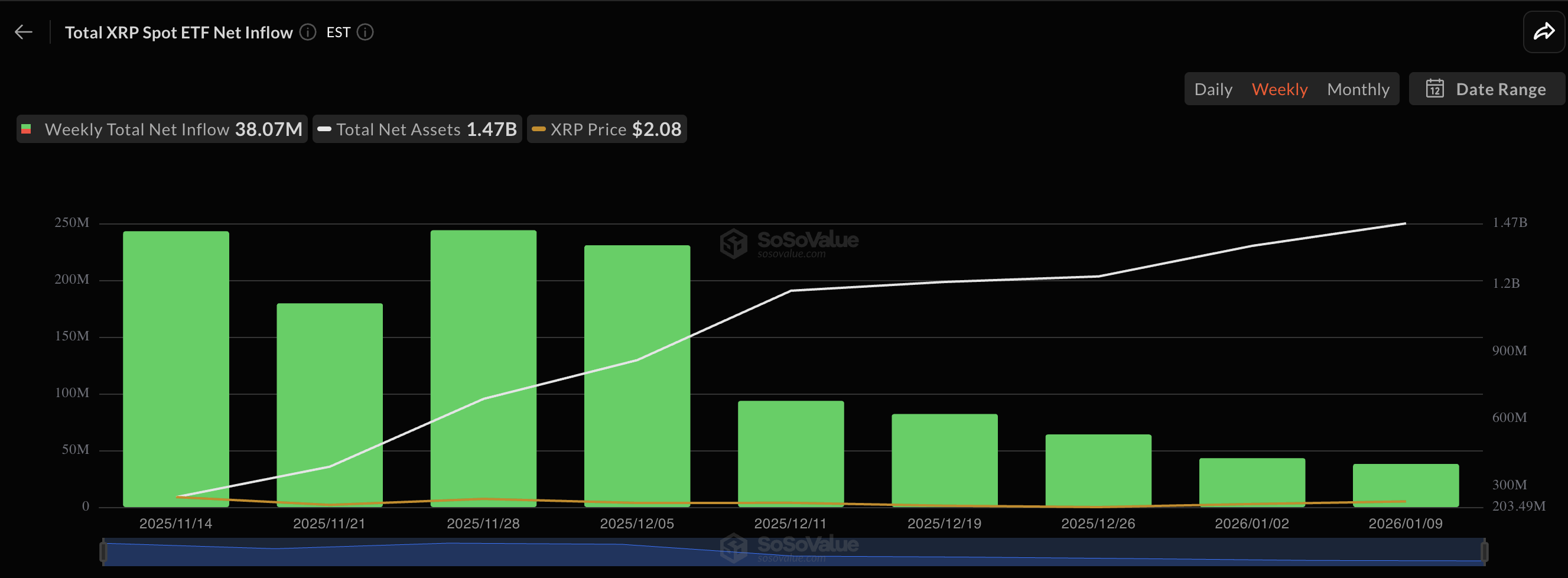

Data from SoSoValue reveals that the XRP ETF market saw an additional $38.07 million in value for the week ending January 9. However, a look at the chart shows that the capital inflow for the crypto-linked products is steadily declining.

As of this writing, the spot XRP ETFs have accumulated $1.47 billion in total net assets since launching in mid-November 2025. Canary Capital’s XRPC tops the list with $375.1 million in net assets under management (AUM), followed by Bitwise’s XRP fund at $300.3 million, and Franklin Templeton’s XRPZ at $279.6 million.

While the XRP ETFs seem to be enduring the market storm, the more-established Bitcoin and Ether ETFs have seen better days. According to recent market data, the crypto funds saw a combined withdrawal of $749.6 million during their first full trading week of the year.

Most notably, the spot Bitcoin ETFs saw their largest single-day net outflows of $486.1 million on Wednesday, January 7. The BTC exchange-traded funds closed the week with a net outflow of over $681 million.

Meanwhile, the Ethereum ETF market, which started on a positive note with inflows of $168.1 million on January 5 and $114.7 million on January 6, eventually ended the week with net withdrawals of $68.6 million.

—

Blog powered by G6

Disclaimer! A guest author has made this post. G6 has not checked the post. its content and attachments and under no circumstances will G6 be held responsible or liable in any way for any claims, damages, losses, expenses, costs or liabilities whatsoever (including, without limitation, any direct or indirect damages for loss of profits, business interruption or loss of information) resulting or arising directly or indirectly from your use of or inability to use this website or any websites linked to it, or from your reliance on the information and material on this website, even if the G6 has been advised of the possibility of such damages in advance.

For any inquiries, please contact [email protected]